Welcome back to The Raise. This issue, we have the pleasure of speaking with Scott Dommett, Investor at Rampersand VC. Rampersand seeks out founders with abnormal potential, with a hardcore focus on big visions, big ambitions, and big beliefs. Their portfolio includes companies like Hatch (a.k.a Seek for GenZ), JigSpace (a.k.a the Canva for 3D), and mx51 merchant technology (investing alongside Mastercard and Artesian Capital).

Last month, Scott travelled to the United States, gathering up a heap of wisdom to bring back to the ANZ startup community. So in the spirit of “mateship” - Scott shares what he learnt 👉

watch

Check out the full length interview or follow on Spotify for the new episode (live within 24 hours).

read

Skim the show notes from our chat with Scott Dommett:

Play up ANZ’s capital efficiency - One thing that they love about us is capital efficiency. The US has capital abundance in the venture ecosystem and lots of tech companies being built. Australia & New Zealand have a slightly more nascent ecosystem, and are a little more conservative in the way it deploys cash (less cash + smaller round sizes). This, alongside the like cultural differences between us and the USA is actually means you get these incredible ANZ founders that are able to do so much with a lot less than what the US people are able to do. And the Americans love it because what we’re able ton convert with a small elite team is factors ahead of what US founders can do with each of their million dollars.

US customers are a must have - “Generally, even if you've scaled well in Australia and New Zealand, if you don't have proven ability to go to market in the US, and that's either through revenue traction or user traction, they'll tend to discount your ANZ revenue to zero. So if you feel like you should be raising a seed round over there, they'll be like, yeah, but it's too risky for us because we don't know whether you're going to be able to break into the US. And so you either can't raise the round or they'll just push you a round earlier. That all changes once your revenue is starting to look like 50% from the US or you have a few more customers over there, Then they will no longer have to discount your ANZ revenue because they'll know that that revenue is also proof that there are customers in Asia Pacific region. It starts to accelerate once you have those first US customers, they start to pay attention to you, like, can think of you as “REAL.”

Get comfortable with the hustle - Networking over there is next level. After a ten minute conversation, LinkedIn requests are flying out before you’ve even learnt the person’s name. While it might feel surface level, people are forthcoming with friendly introductions e.g. “you have to meet this person, you're building in the same space, you need to sell to this person etc.” And then they would actually make the connection. You’d be getting instantaneous value adds.

grow

Trends we’re noticing: Goodbye, Unicorn Status.

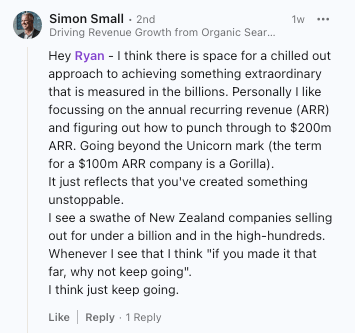

Last week I wrote an article about defining startup success for ourselves. It sparked a bunch of comments. Both sighs of relief, ‘finally someone said it,’ and frank acceptance that building any business is hard - ‘$1B versus $100m - both paths are difficult, might as well keep going.’

👉 Head over to LinkedIn to share your take.

Tech Spotlight: Sunrise Aotearoa comes to Welly

Exciting news for the tech and startup community! Atlas Digital is thrilled to partner with Blackbird to support Sunrise Aotearoa on November 26th, in our hometown of Wellington.

Sunrise is about encouraging the next wave of innovators by sharing inspiring stories of how NZ & Australia’s most impactful startups were built.

We’re stoked to be getting amongst Sunrise Aotearoa - it's our way of being there behind the scenes for hardworking Kiwi and Aussie founders who want to change the world.

There’s an incredible lineup of speakers and panellists so follow link above to grab your tickets 🌅

🎤 Here’s some notable folks from the speaker lineup:

Tim Doyle | CEO/Co-Founder of Eucalyptus

Flavia Tata Nardini | CEO/Co-Founder of Fleet Space Technologies

Peter Beck | CEO/Founder of Rocket Lab

Penelope Barton Barton | CEO of Crimson Global Academy

David Booth | Entrepreneur in Residence & Investor at Blackbird

Got a success story? Hit reply and let us know! Nominate yourself or somone in your network.